Pump market sees positive growth despite COVID-19 setback

Industry experts discuss efficiency and electrification trends.

By Nicole Krawcke

Much like any market segment in the PHCP industry, the outlook for pump products continues to evolve — especially given the past year’s challenges with the COVID-19 pandemic.

“By most measurements, the market is growing because our economy is gradually recovering from last year’s trauma, no thanks to COVID-19,” says Mark Chaffee, vice president of governmental affairs and commercial and industrial product management for Taco Comfort Solutions. “Growth of the pump market — part of our steady but slow economic recovery — will however have substantial regional and industry segment variances. New commercial office space construction is one of those areas where the dramatic shifts in how and where we now work will have a long-term effect. However, that seems to be offset by increased spending in decentralized medical buildings, health-driven upgrades to schools and anticipated federal spending on increasing building efficiency.”

Additionally, the increasing demand for water has a direct correlation with the growth of the pump market.

“This is especially true in developing regions across the globe,” says Jessie Hinther, central regional manager, U.S. Industrial, for Franklin Electric and Pioneer Pump. “The planet’s population also continues to increase so we anticipate this growth trajectory to be sustainable for the foreseeable future.”

Ludmila Podwell, business development manager, Americas, for Davey Water Products, explains the overall pump market is growing at a fair 4% to 5% rate, and over the next six to seven years, is expected to reach more than $125 billion, per global research.

“Some of the obvious reasons are increases from the water and wastewater industries where the developments in the infrastructure are pushing for pump demand,” she says. “Oil and gas, chemical and mining industries are driving pump demand as well.”

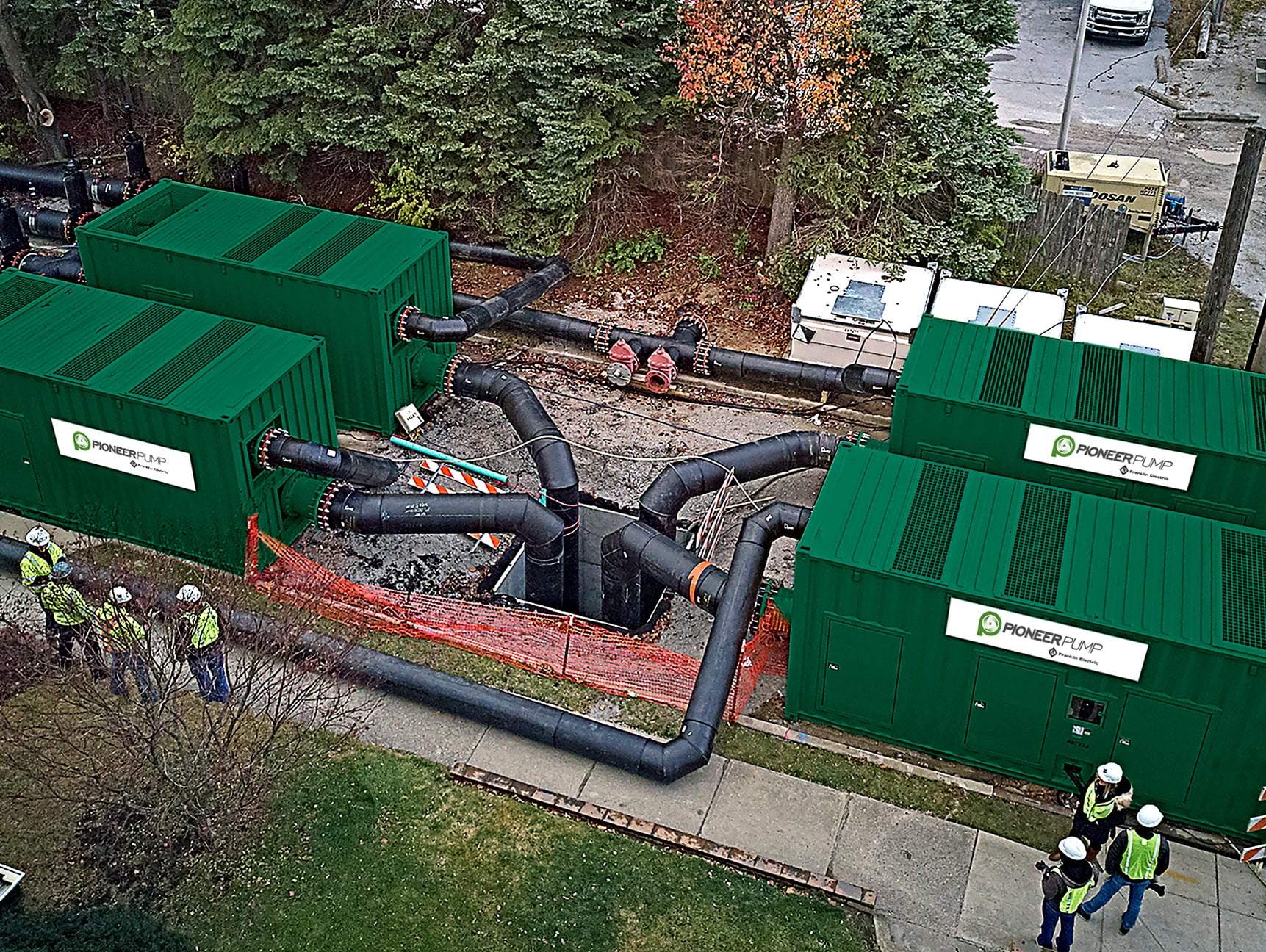

Pioneer Pump, a Franklin Electric brand, provided a large-scale sewer bypass solution to a local municipality for a capital improvement project that entailed more than 2,800 linear feet of 84-inch sewer pipes. Four Pioneer Prime 18-inch Sound Attenuated Diesel Pump Packages were designed and manufactured in record time to handle the 47 million gallons of wastewater that flow through the pipes daily. Photo courtesy of Franklin Electric.

A condominium complex in need of a low-pressure sewer system installed Franklin Electric’s FPS PowerSewer System – an ideal wastewater solution for small- to medium-sized communities in any location. Photo courtesy of Franklin Electric.

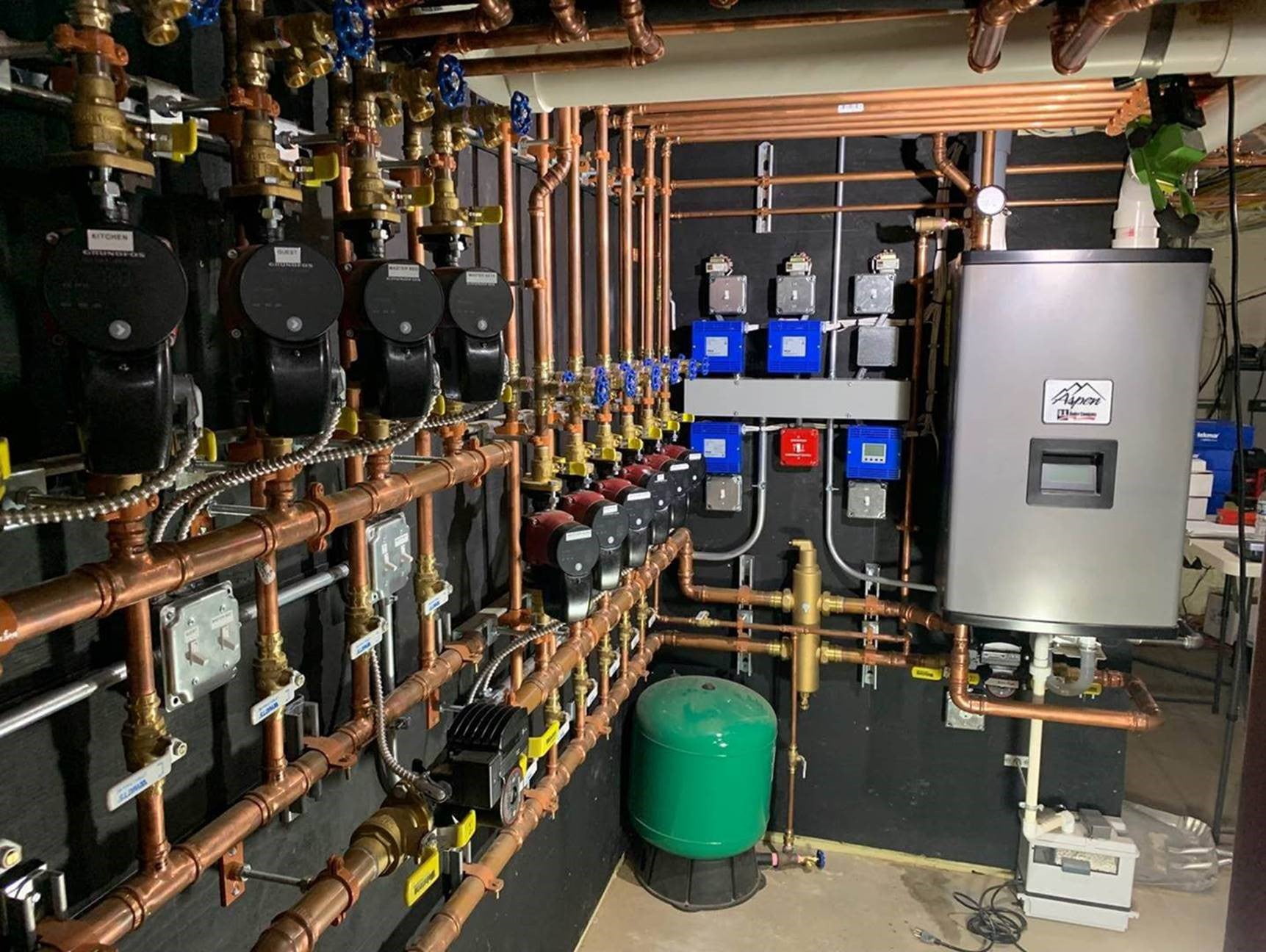

Grundfos ALPHA pumps were added to a complete mechanical room remodel for a homeowner in Hamilton, Massachusetts. Compared to a standard circulator, installer Tim Lane Plumbing estimates an annual $40 savings for each of the 15 pumps. Photo courtesy of Grundfos.

Where the opportunities lie

Alan Jones, director of product management, global residential and CBS/HVAC Americas for Xylem, notes the pandemic has impacted different market sectors in different ways.

“As a whole, the market is growing on a dollar basis faster than a unit basis as people are investing in more expensive pump and drive systems that pay for themselves in energy savings,” he says. “We are continuing to see growth in data centers and warehousing with the significant increase of online shopping. We are also seeing residential investment booming as the pandemic has impacted the housing market and caused people to spend more time in their homes leading them to either invest in remodeling or relocate.”

According to Kirk Vigil, vice president of sales for Grundfos USA, there are two separate markets for residential circulators; heating and plumbing/hot water recirculation. While the residential wet heat market has been stagnant for some time, the replacement market remains robust, he notes.

“New construction has been challenged by efficient, lower cost alternatives to wet heat,” Vigil explains. “Hot water recirculation has been on a growth trend, and the outlook is good as homeowners and builders gain awareness to solutions for waiting for hot water. There are also a growing number of state legislative requirements for hot water recirculation.”

Hinther adds there has been an increase in the number of stormwater remediation products put to use due to the number of recent natural disasters across the U.S.

“There has also been an uptick in commercial construction that has provided growth opportunities in certain regions,” he says. “Additionally, the amount of potable water consumed and wastewater transported/treated has increased exponentially with the hand-washing/sanitization procedures suggested by the CDC.”

The residential hydronic heating market has remained the healthiest through the tough, COVID-19 pandemic — mostly because people have spent so much more time at home, according to Chaffee.

“Throughout the winter months, spending to maintain and improve residential hydronic systems has been relatively strong,” he says. “And, for those who’ve had a taste of what being at home is like with, say, a basic heating system, there’s been a real uptick in interest in, and spending for, the comforts that a modern hydronic system can provide.

The commercial market has seen some sign of hope, too, Chaffee adds.

“With many buildings empty, or at low occupancy — especially schools, hotels, institutional and office facilities — some facility managers have smartly turned their attention to service work and upgrades to aging mechanical systems,” he notes. “The push towards energy efficiency continues. Pump systems account for about 40% of industrial energy use, but they don’t have to. Last year, if we had simply selected more efficient pumps, with a minimum HI Energy Rating of 50, we could have saved 14.2 terawatts of electricity and the greenhouse gas equivalent of electricity to power more than 13 million homes! [See HI infographic below]. The pump market has the power to make significant environmental impacts while driving overall growth.”

PUMPS POWER ENERGY & COST SAVINGS

Pumps can account for 40% of industrial energy usage¹.

Designing pump systems to reduce energy consumption is one step toward greater sustainability.

1 US DOE Motor Market Assessment

MANUFACTURERS SEE THE BUSINESS CASE FOR SUSTAINABILITY

According to a 2019 NAM Sustainability Survey Report:

>80% of manufacturers said they have a sustainability policy

in place or are developing one.

93.8% of companies surveyed

track energy usage.

Top Drivers of Manufacturer Sustainability Policies

Company’s

business model

preference

Market/

consumer

demands

Investor

demands

Customer

demands

Government

regulations

All of the above

0

%

0

%

0

%

0

%

0

%

0

%

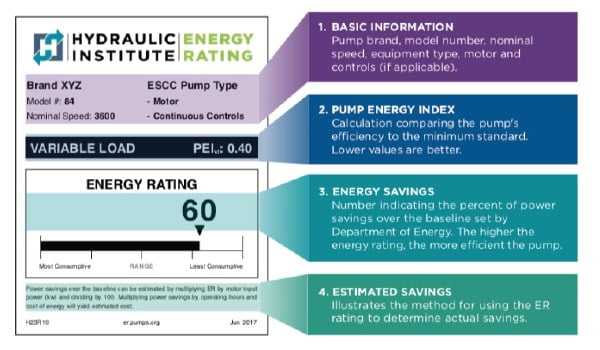

THE LABEL

THAT UNLOCKS

SAVINGS

The Hydraulic Institute (HI)

Energy Rating Program

allows users to view and

verify data on pumps that

indicates the power savings

obtained from upgrades

and changes.

OTHER METRICS FOR SUCCESS

Don’t forget that pump cost, installation and energy savings are only part of the equation. Energy-efficient pumps that vary their speed to meet demand can also save costs by boosting reliability and reducing expenses tied to INDUSTRIAL maintenance, operation and downtime.

IMAGINE THE IMPACT

Selecting pumps within an HI Energy Rating of 50 for all new pumps installed in 2020 could unlock energy savings of:

- 14.2 TWh annually

- 162.9 TWh of electricity over an 11-year pump lifetime

According to the EPA’s greenhouse gas equivalency calculator, that greenhouse savings would represent:

A year’s worth

of electricity for

more than 13

million homes

Carbon sequestered

by more than 1.9 billion tree

seedlings grown

for 10 years

The CO2

emissions from

more than 12.9

billion gallons

of gas consumed

INDUSTRIAL

BUSINESSES

CAN SAVE BIG

OVER TIME

If an industrial plant using

40 pumps operating at an

average of 15-hp switched or

modified pumps to achieve

an energy rating of 50, that

business would save:

1.3 million kWh per year, which roughly equals...

$117,000

in annual savings

>$1.3 Million

in cost savings over an

estimated 11-year lifetime

of the pumps

114%

Internal

rate of return

<11 mos.

Simple

payback

PUMP LIFECYCLE COST

FIND THE

RIGHT

SOLUTION

Learn more about HI’s Energy Rating Program and search the database of rated pumps to find your solution. Visit http://pumps.org/EnergyEfficiency.

The Energy Rating Label Program is part of HI’s ecosystem of energy efficiency training, certification and standards initiatives to raise awareness of energy saving options, including Pump Systems Matter Training, PSAP Certification, Lab Approval and HI Test Standard.

Infographic by Hydraulic Institute; provided by Taco Comfort Solutions.

.

Podwell notes a lot of new demand Davey is experiencing is consumer-driven.

“Take the water transfer, treatment and boosting applications — low water pressure and fluctuations result in diminishing satisfaction from shower experience, it effects the quality of dishwashing, laundry and other basic, but every day necessary tasks in the household,” she says. “In a very recent past, many homeowners would not give much thought to the water pressure in their home. It was something many treated as ‘given and not disputed.’ But with the constant drive in infrastructure improvement, better overall awareness through social media and marketing efforts, a ‘booster pump’ is fixing the low water pressure issue, and turning into a valid appliance in the household. It becomes just as important as a fridge or a dishwasher.”

Efficiency and electrification

In the commercial market, there is a definite trend toward packaged systems, according to Jones.

“Packaged systems are typically designed with redundant capacity, operate efficiently at variable loads and allow for shorter installation times,” he explains. “It is a crossroads of the latest technology, space efficiency and time savings. On the residential side, we are seeing smarter systems. Homes are becoming connected. People expect their doorbell to be smart, and they will expect their plumbing system to be as well.

“The whole world seems to be moving faster,” Jones adds. “The days of lengthy apprenticeships and an abundance of skilled tradespeople are behind us. As a result, pumps and pumping systems need to be turnkey from selection to installation.”

Vigil notes there is an ongoing transition to efficient circulators.

“‘E-circs’ continue to be a larger part of the circulator mix,” he says. “Energy efficient pumps and circulators are becoming more competitive as more manufacturers and models enter the marketplace. E-circs are also supported by various local utility programs making them more affordable.”

According to Hinther, the market is seeing a trend in energy efficiency and the incorporation of variable frequency drives (VFDs) into systems.

“Also, in the wastewater segment, we are seeing a need to increase the pump’s ability to effectively pass solids,” he explains. “For example, the recent increase in flushable wipes entering the waste stream has led to an increase in the amount of maintenance required for lift stations. These trends are driven by the goal to minimize downtime and reduce overall operating costs to provide significant cost savings for end-users. The pandemic has many municipalities struggling financially due to decreases in tax revenue.”

Another major trend in the pump market is the continuing expansion of strategic electrification, Chaffee notes.

“These initiatives are supported by more local utilities and state regulators, and fits with the new administration’s environmental stance as indicated by President Biden’s early executive actions,” he explains. “This is where we see the continued growth of VRF, geothermal and water-sourced heat pump systems, especially in commercial and community based projects, along with hydronic-based air-to-water heat pumps having a major impact in future-proofing a house or building’s HVAC system while delivering heating, cooling and domestic hot water production. The best part is that the global warming potential (GWP) of water is 0! Sure, you still need the refrigerant for the heat pump, but it’s kept at a bare minimum, is factory sealed and outside the building.

“Under the last administration, we saw a hands-off approach to free-market growth,” Chaffee continues. “Under the Biden presidency, and now with our reconnection to the Paris Accord, it seems certain there’ll be an emphasis on the environment, with energy efficiency improvements to existing buildings on the front burner. Also, increased infrastructure spending, supported by both political parties. Not just roads and bridges, but on our aging water infrastructure as well, including significantly increased investment in state revolving funds.”

Under the Biden administration, Chaffee notes we are sure to see: “More incentives for energy conservation — especially at commercial, institutional and industrial facilities through federal rebates; subsidies for the purchase and installation of energy-conserving and IAQ technologies; incentives to manufacturers for develop of higher efficient technologies; attention to commercial and industrial building improvements; and increased recognition of the importance of hydronic system enhancements, with emphasis on pumps.”

Taco was deeply involved in the DOE’s effort to bring about the labeling of commercial pumps, Chaffee points out.

“We now believe the emphasis will again return to accomplishing the same for residential circulators,” he says. “This will likely focus attention on the need to replace remaining non-ECM pumps and circulators with far more efficient ECM-powered equipment.”

Podwell agrees the market will see stricter government regulations effecting pump efficiency improvements along with rapid technology advancements, making the pumps “smarter and smarter.”

“These are all driven by the improvements in the technology, environmental concerns and our customer demand,” she says.

Wallace Eannace designed a solution using Bell & Gossett VSX-VSC pumps during a recent project at Rockefeller Center's ice skating rink. Photo courtesy of Bell & Gossett .

Here, a LOFlo injection mixing system is commissioned to enhance the performance of a building’s chilled beam system. Photo Courtesy of Taco Comfort Solutions.

During a recent new construction residential community installation project in Zebulon, North Carolina, Davey BT14-30 booster pumps were utilized in every home to increase municipal water pressure to solve the low water pressure issue in the community. Photo courtesy of Davey Water Products.

Future expectations

According to Jones, much of the innovation will be on the motors and controls for pumps along with connection to cloud services.

“This will lead to not only improve individual product energy efficiency, but help to optimize overall system performance,” he says. “Big data is going to help bridge the gap we have had in achieving truly preventive response by diagnosing many issues before they even occur.

“We will continue to see an evolution in how pumps are employed as new system designs focus on zero carbon initiatives,” Jones adds. “We will also see a greater focus placed on systems that are capable of purification, whether that be air or water. We have learned some lessons from this pandemic, and we anticipate it is going to change how we monitor the environment and our speed of response to issues, as well as regulatory changes regarding building codes and system efficiency.”

Vigil agrees that future domestic pumps will have connectivity to home networks and hubs, so we can expect more data-driven technologies to appear in the near future.

“We will see more app-driven features benefiting installation, operation and monitoring of domestic pumps,” he says. “Safety and convenience features will also be added to energy efficient pumps.”

Podwell notes product innovations in collaboration and connectivity continue to be on the horizon in this market segment.

“We will see product digital connectivity and data management, not just at the end user level but at the dealer and manufacturer level,” she says. “I would like to quote Davey Water Products CEO David Worley at our latest quarterly meeting. David suggested that ‘Over time, the role of information may change our industry to a role of a service agent.’ It leaves a lot to an interpretation which might be a good topic for a later discussion.”

Taco has plans to expand its ECM product lines substantially, including expansion to its family of commercial pumps to include ECM capability up to 30 hp, Chaffee notes.

“As mentioned earlier, we see the convergence of what the HVAC industry has learned during COVID with the climate policies of the Biden administration, the market will head toward the need for enhanced efficiency and improved ventilation,” he says. “If buildings are to remain in operation, then it’s with a greatly heightened awareness of the financial importance of improving energy efficiency in concert with maintaining the health and well-being of anyone who steps inside the building. Luckily our industry has the answers, solutions to these rather complex challenges. So in that respect, there’s a silver lining to the crisis we now face.”

“Water is one of our greatest resources, and is often taken for granted,” Jones adds. “Hopefully we are creating a new awareness of the importance of water in our lives and the importance of our systems that interact with it.”

Nicole Krawcke, is chief editor of PM Engineer.